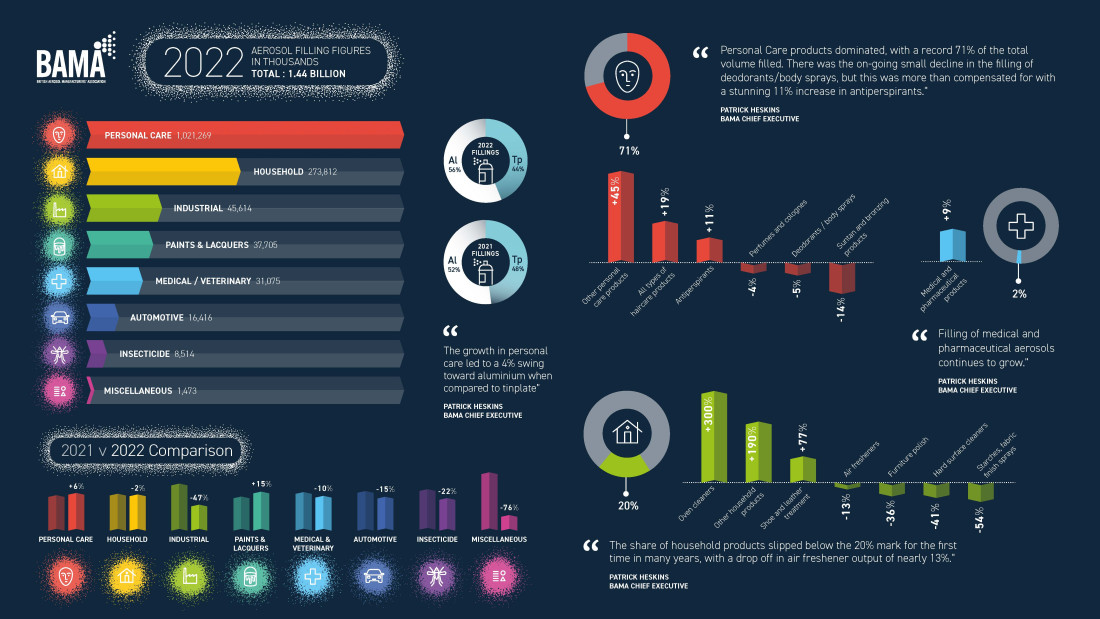

UK Aerosol filling held up remarkably well in 2022, despite the host of supply issues which the industry faced. Patrick Heskins, BAMA Chief Executive, takes us through some of the key figures.

As always, Personal Care products dominated, with a record 71% of the total volume filled. There was the on-going small decline in the filling of deodorants/body sprays, but this was more than compensated for with a stunning 11% increase in antiperspirants.

“The haircare category saw a 19% increase as products such as dry shampoo and root concealers grow in popularity, with a wider range of options for consumers to try, whilst we appear to have hit “peak beard” as the number of shaving products filled has stabilised”.

“Clearly the aerosol package is being used by marketers more often as ‘Other personal care products’ (i.e. shower gel and mousses, insect repellent, feminine products, depilatory creams) increased by nearly 45%, although there was a significant decline of 14% in the number of self-tan aerosols produced”.

“The share of household products slipped below the 20% mark for the first time in many years, with a drop off in air freshener output of nearly 13% and the continuing slow decline in production of furniture polish. The total volume for Household appears boosted by the inclusion of lubricant sprays under ‘Other products’, with a consequent decrease in the volume of Industrial Aerosols”.

“There was also a drop in the quantity of hard surface cleaners filled in 2022. Production in the category surged during COVID but as restrictions were eased so did the demand for disinfection products generally. A positive for society maybe, not so good for aerosol manufacturing. Hopefully the improvements in hygiene standards which were seen during and just after COVID, in public spaces and on public transport, will not just disappear now the worst of this infection is behind us”.

“Filling of medical and pharmaceutical aerosols continues to grow. This category includes medical devices, various OTC medicines and para-pharmacy products but does not include prescription medicines, such as asthma inhalers”. After the initial boost in veterinary and pet care sprays led by the working-from-home need for animal company, the filling volume has now settled back to the previous years’ average.

“Paints and lacquers fillings grew in the year, but there was a small drop in the number of other Automotive products manufactured. Taking out the shift in lubricant sprays from Industrial aerosols to Household, the Industrial aerosol category held up extremely well. Insecticide filling, which has never been a strong segment of the UK aerosol production, continued at a similar level to previous years”.

“Similarly, the filling of food aerosols has not been a big sector for the UK fillers, and the small volume filled until recently has now shrunk to insignificance. Likewise, the miscellaneous category, which include novelty products such as silly string and snow sprays, has declined as, in particular, the regulatory pressure on the propellant gases used for many years starts to have an impact. Many of these products still find their way on to the UK market from overseas manufacturers: whether they actually meet the UK regulatory requirements is something those placing them on the market should check very carefully”.

The growth in personal care saw a 4% swing toward aluminium when compared to tinplate. It should be noted that there are some plastic and glass aerosols filled in the UK but the numbers are very small and production is focussed on two manufacturers, so BAMA is unable to publish those figures.

“We hope 2023 will allow us to get back towards the volumes we enjoyed in the late 2010’s” is Patrick’s conclusion, “there are certainly a variety of challenges coming our way as an industry, but the consumer demand for products in the aerosol format doesn’t appear to be diminishing which we must use to support our business whilst we develop the next generation of products with ever-increased environmental credentials”.

BAMA News

24.04.23