The final figures for the UK aerosol industry 2021 output show interesting variations, with the total number of tinplate steel containers catching up with the previously dominant aluminium.

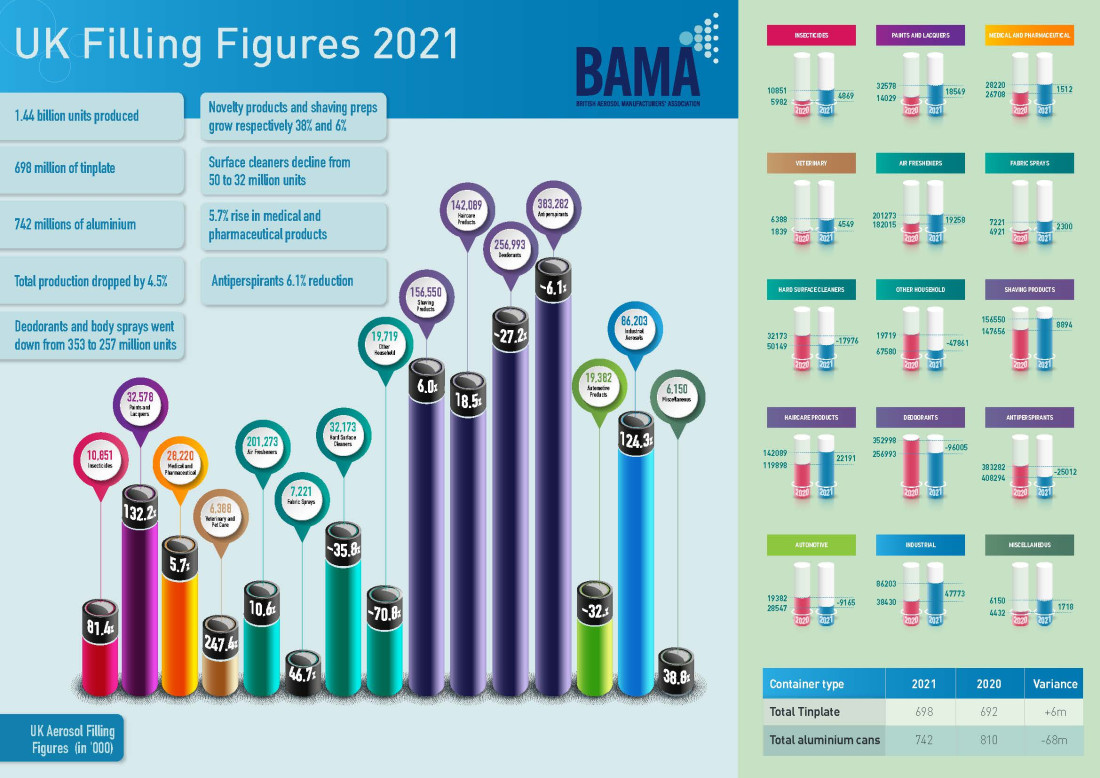

Of the 1.44 billion units produced, 698 million, equal to 48.5%, were made of tinplate, with the remaining 742millions of aluminium. Compared to 2020, the total production dropped by 4.5%: almost 75million units.

The narrowing of the gap in the aluminium to tinplate ratio is due to a reduction in the output of deodorants and anti-perspirants, categories that represent the bulk of the UK production. Deodorants and body sprays went down by circa 27%, from 353 to 257 million units, while the reduction in antiperspirants was 6.1%, a reduction of 25millions.

These rather dramatic numbers are due to the running down of stock built up during the peaks of the pandemic and it translates into the first significant decrease in the UK's overall production for 2021. On the matter, Patrick Heskins, BAMA’s Chief Executive, says “It is the first time in many years that we have seen such a dip in production, but given the economic & political situation of the past two years, I would say that our industry survived remarkably well.”

The large change from the previous year in the Household Sector and the Industrial categories is due to a shift in reporting of some specific products, rather than to sudden market changes.

Haircare products and starches have picked up after the 2020 slump, with an extra 22million units output for haircare (18% more than the previous year) and 2.3million more units for fabric sprays, possibly following the gradual return of office staff to the workplace.

Hard surface cleaners saw a decline of almost 36% from 50 to 32 million units, a change to be expected after the cleaning frenzy of the first stages of the pandemic. Nasal sprays, a relatively new product that has grown in popularity outside the UK, have influenced the 5.7% rise in the medical and pharmaceutical products category, while the sustained growth of flea sprays and veterinary products appears in line with the peak in 'pet adoptions’ seen during 2020.

The cause behind other variations is not quite so obvious, for instance, the 80% increase in insecticide or the 132% increase in paints and lacquers. A large share of the UK production has traditionally been destined for export. The different timing of lockdown from one country to the other, and unusual demand due to extreme weather conditions around the world, could have influenced these results.